Deal Memo: Density.io

Yesterday, the first private company I ever invested in was valued at $1 Billion. Here’s the story:

The story

In 2017, I wrote my first-ever check investing in a startup. The minute we sent the transfer, I felt palpable... relief. Why? Because I was losing sleep. I could feel in my bones that this company was going to be successful. And I didn’t want to miss the opportunity.

I had become friends with, loved, and respected the founders. I wished I could clone myself and go work at the company -- because it would be fun, educational, to be a part of this amazing story so I could sleep again.

But, I couldn’t leave my company, and I loved my job, too. We had just recapped and were rebuilding strong. The whole team was excited about the road ahead.

The Density team was stellar, and they were working on a clear problem in an overlooked market that had the potential to become huge. (More to come on that.)

This opportunity had all-caps “YES”’s for all of my criteria for personal angel investment:

Founders I love and respect? YES

Working on a problem in a big enough market? YES

Wish I could clone myself and go work there? YES

So, I wanted to put my skin in the game.

I didn’t have much spare cash… it took me more than 6 months to save up the $5,000. I still didn’t meet the minimum requirement for investment.

But I didn’t give up.

To meet the minimum, I pitched Bo (then the CEO of the startup I worked at) to join and invest as well. He’s a much more experienced (and capitalized) investor, so when he met Andrew (CEO of Density) and liked the idea as well, he invested and I held on tight to those coattails to get into my first deal.

Sharing below a write-up of my thesis in three parts (People, Market, Product). My whole thought process for investing in Density.

Side Note: I’m considering creating a vehicle for you to co-invest with me on deals like this. If you get are excited about that idea, email or DM me and let’s talk about how to work together.

People

I’d become friends with some of the founders (specifically Andrew and Ben, though I loved each of them that I’d met.) I knew even if the company didn’t work out, I’d have been proud to support them and their vision. It was clear they would do their best to honorably execute their vision.

Andrew, the CEO, has black eyes and flowing hair. He was born on New Year’s Day, like a protagonist from some sci-fi novel--he seemed destined to lead and succeed. He is a sharp thinker and a ruthless operator with a tender heart.

Ben, the (former) head of engineering, is the most earnest learner I’ve ever met. He dives into completely new technologies and industries, quickly building roots, trunks, and branches of knowledge. As a friend, Ben is thoughtful, considerate, and constantly calm. Just brilliant both intellectually and emotionally.

The rest of the team is also great, I just don’t know them quite as well :) The team had already been working together as a web development agency in Syracuse for years -- so the first 6+ hires were locked-in. This meant a strong founding culture, and a meaningful reduction in the risk of existential co-founder disagreements.

This team was resilient, hard-working, and smart about their thing. They got smart about their thing by learning incredibly fast, which is probably the most important factor for early-stage startup success. I’d seen them iterate through possible solutions, meet people, and cycle through customers and value props quickly and effectively while trying to find product-market fit.

People: Amazing.

Next...

Market

The market has to be huge. For this type of startup investing, the market should support multiple $100m+ enterprise value companies.

Density provides a people-counting market, helping to manage capacity and use space effectively. Every time you see a human at a door clicking a counter up and down, that’s people counting. Turnstiles in museums and subways? People counting.

Fun fact -- what % of commercial real estate in the US do you expect is paid for, but unoccupied? You guess, I’ll tell you at the end of the post.

At first look, the People Count market where Density operates barely clears this hurdle (if it clears it at all.) Quick-n-dirty google research puts the market size somewhere between $100m and $1b/year. However, the second-order effect is very important in market sizing, and people tend to forget to apply this mental model.

Truly great companies grow markets. Through some combination of decreasing cost, additional capability, distribution, or other innovations they expand the size of the market, sometimes by orders of magnitude.

Uber/Lyft massively expanded the size of the taxi market. Early market size research would have said uber might capture a fraction of that. Good investors saw they would expand the market and re-define transportation.

Airbnb massively expanded the size of the short-term rental market. Early market size research would have said Airbnb might get a fraction of hotel sales. Good investors saw they could create a new market category and damn near a new industry.

I liked two things about the people-counting market: 1) it was overlooked, and 2) it was clear that the right solution could massively expand the market.

Density’s solution was driven by a new enabling technology (computervision), it had new functions (anonymity at source, real-time), and economies of scale—which all contribute to my theory they would expand the market.

We also like to look for general “tailwinds” to an industry or problem. If the problem solved tends to get worse, solutions will have more demand and more value over time. In the People Count market, the cost of real estate keeps rising, the number of people keeps rising, the desire for privacy keeps rising… all good tailwinds for solutions in People Count.

This space seemed perfectly ripe for an expanding innovation. I distinctly remember doing research, and finding the Wikipedia page for People Count technology, and thinking…

“I’VE NEVER SEEN ANYTHING MORE OBVIOUS”

I see the future, a new section called “4th Generation: Computervision (2018 - present)” with “99+% accurate”

Market: Strong in that it looks weak, but is ripe for expansion. Strong tailwinds.

Check. Next...

Product

This super-cool hardware device is mounted over a door frame. It costs $895. Density manufactures them themselves in the USA, and sells them to organizations with large campuses to manage (companies, universities, governments).

Inside the unit, thousands of individual depth sensors create a rough image of what is below the doorframe. The image is rough because these sensors are designed to always be anonymous (rather than using cameras, which could be hacked or abused).

Then computervision algorithms trained on mountains of data over many years study the shapes, determine whether it’s a person, a dog, or a roomba, and adjust the count in the space accordingly.

Density sells the units, but also earns money on a monthly basis for their algorithm, interpretation of the data, and the dashboard of space management tools for their customers.

I’d seen the team iterate through all of the possible people counting technologies (break beams, MAC address tracking, thermal), and all had flaws. It was clear this was the path to providing the very best solution in the market.

And, more importantly, it would provide Density with what Keith Rabois calls an “accumulating advantage.” The bigger the company gets and the better the algorithms, the better the product they can provide for their customers.

Product: All-around genius. Hard-won insights executed well after many years of learning.

Decision: Invest in Density

$5,000 invested at a $50 million valuation in Series B round, April 2017. It felt great to put some money to work, and fun to be betting on my friends.

Today, they’re worth $1B. And most exciting of all… they’re just getting started. A long way from a few friends building a web development agency in Syracuse, NY.

Work with Density

Demand is massively outpacing supply, and the team is expanding quickly to continue growth.

I count FIFTY open roles on their career page, for all types of skills and backgrounds.

Everyone I know at the company is a wonderful kind genius. I know this first-hand because (and as a disclosure) my fiancé now works at this company, leading HR.

If helping people stay safe and providing the data input for the reinvention of real estate sounds interesting to you, check out some of the opportunities.

Invest with us

I’m considering setting up a vehicle for co-investment in deals like this. If you’d like to invest alongside us, please send me a private email or DM and we can discuss it.

Oh, yea -- your Fun fact answer: Last I heard, ~40% of commercial real estate in the US is paid for but unoccupied. Think those companies want Density to help them get a little more efficient?

Notes:

I did write this in 2021, so there is some ex-post-facto risk here. Though, I was working from notes and paper trail from 2017… so it’s certainly not a full reinvention of the narrative.

Obviously, I have shares in the company, so all imaginable disclaimers about my neutrality apply.

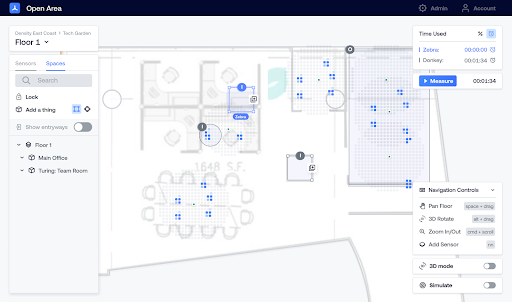

There are incredible new products like Open Area which shows space usage of a whole room anonymously in real time… like a Marauder’s Map from Harry Potter. I didn’t include this in the main post, because the product didn’t come out until 2020 so it wasn’t a part of the investment decision.